The myths and realities of Duterte’s infrastructure initiative

- By Dan Steinbock

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, August 1, 2017

E-mail China.org.cn, August 1, 2017

In the past year, President Duterte has initiated a series of economic reforms to accelerate economic development. Despite much "political noise," the government seeks sustained growth around 6.5- to 7 percent in 2017, by banking on multiple initiatives, especially higher infrastructure spending.

According to Ernesto Pernia, Director General of the National Economic and Development Authority (NEDA), investment spending must be ramped up to 30 percent of GDP for the Philippines to become an upper middle-income economy by the end of Duterte's term in 2022, and to pave the way for a high-income economy by 2040.

Yet, the huge infrastructure investment effort has been often misreported internationally. Infrastructure investment is a case in point.

The allegation: Infrastructure as ‘debt slavery'

In early May, Budget Secretary Benjamin Diokno estimated that some $167 billion would be spent on infrastructure during President Duterte's six-year term. Only a day later, US business magazine Forbes released a commentary, which headlined that this debt "could balloon to $452 billion: China will benefit."

According to the author, Dr. Anders Corr, the current Philippine government debt of $123 billion is about to soar to $290 billion because China, the "most likely lender," would impose high interest rates on the debt: "Over 10 years, that could balloon the Philippines' debt-to-GDP ratio to as high as 296 percent, the highest in the world."

These figures assume absence of transparency by the Duterte government and China on the interest rate, conditionality and repayment terms of $167 billion of new debt for the Philippines. Due to accrued interest, "Dutertenomics, fueled by expensive loans from China, will put the Philippines into virtual debt bondage if allowed to proceed." Corr assumes China's interest rate would amount to 10 percent to 15 percent.

But why would the Philippines accept such a nightmare scenario? Because, as Corr puts it, "Duterte and his influential friends and business associates could each benefit with hundreds of millions of dollars in finder's fees, of 27 percent, for such deals."

He offers no facts or evidence to substantiate the assertions, however.

The official story: Debt decline, despite infrastructure investment

Recently, the Department of Budget and Management (DBM) anticipated the Philippine debt position to remain sustainable, despite deficit spending for infrastructure. Between 2017 and 2022, the Duterte government plans to spend about $160 billion to $180 billion to fund the "Golden Age of Infrastructure." An expansionary fiscal policy shall increase the planned deficit to 2 to 3 percent of GDP.

To finance the deficit, the government will borrow money following an 80-20 borrowing mix in favor of domestic sources, to alleviate foreign exchange risks—which would seem to undermine the story of China as the Big Bad Wolf.

The fiscal strategy is manageable because the economy, despite increasing deficit, will outgrow its debt burden as economic expansion outpaces the growth in the rate of borrowing. So what is the expected impact on the debt-to-GDP ratio?

Given deficit spending of 3 percent of GDP, the DBM assumes growth will be 6.5 percent to 7.5 percent this year and 7 percent to 8 percent from 2018 to 2022 (plus inflation of 2 percent to 4 percent). As a result, it projects the debt-to-GDP ratio to decline from 41 percent in 2016 to 38 percent in 2022.

The realities: Growth over deficit financing

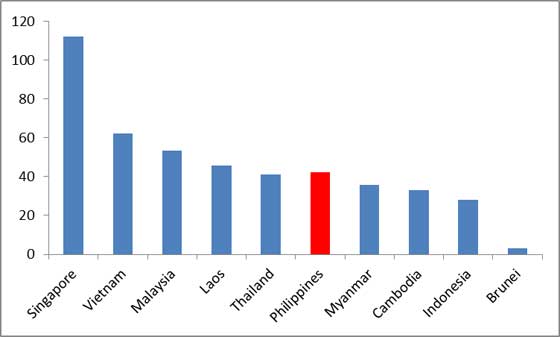

The current Philippine debt-to-GDP ratio compares well with its regional peers. It is half of that of Singapore and less than that of Vietnam, Malaysia, Laos and Thailand (see Figure 1). The starting point for a huge infrastructure upgrade is favorable. True, in a downscale risk analysis, Philippine growth performance might not reach the target, but would be likely to stay close to it – which would still translate to a manageable increase in the debt-to-GDP ratio.

ASEAN: DEBT-TO-GDP RATIO, 2016 (%)

|

|

|

Figure 1 |

Yet, Corr claims that Philippine debt ratio will soar seven-fold in the Duterte era, whereas the DBM estimate offers evidence the debt could slightly decline. The difference between the two is almost 260 percent.

Today, Japan's debt-to-GDP ratio exceeds 250 percent of its GDP. However, at the turn of the 1980s, the ratio was still closer to 40 percent, or where the Philippine level is today. Yet, Corr claims the Duterte government would need barely four years to achieve not only Japan's debt ratio today but a level that would be another 50 percent higher!

The realities are very different, however. The contemporary Philippines enjoys sound macroeconomic fundamentals, not Marcos-era vulnerability. Moreover, Corr's tacit association of Duterte's infrastructure goals with former President Marcos's public investment program (and the associated debt crisis in the 1980s) proves hollow. Duterte is focused on infrastructure (his infrastructure budget as percentage of GDP is 2 to 3 times higher in relative terms).

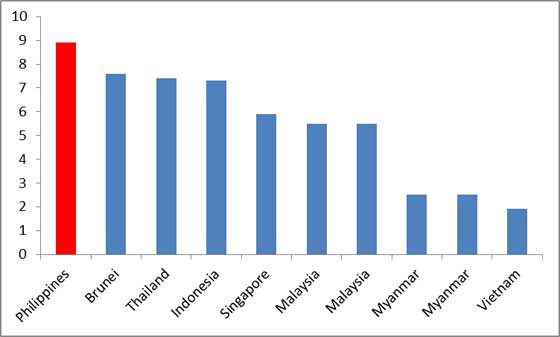

Today, borrowing conditions are also more favorable (365-day Treasury bill rates are 3 to 4 times lower than in the Marcos era). Furthermore, the Philippine gross international reserves, which amount to 9 months, are relatively highest among Asean economies and 3 to 4 times higher than in the Marcos era (Figure 2).

GROSS INTERNATIONAL RESERVES, 2015-2016 (MONTHS)

|

|

|

Figure 2 |

In addition to realities, Corr's analysis ignores the dynamics of debt. Any country's debt position is not just the nominal amount of the debt, but its value relative to the size of the economy. An economy that is barely growing and suffers from dollar-denominated debt lacks capacity to pay off its liabilities, as evidenced by Greece. In contrast, with its strong growth record, the Philippines has the capacity to grow while paying off its liabilities.

Geopolitical agendas, economic needs

Corr could have challenged DBM's assumptions about Philippine future growth, potential increases in infrastructure budget, contingent adverse shifts in the international environment and so on, but his purposes may be political.

He is close to US Pentagon and intelligence communities, which strongly oppose Duterte's recalibration of Philippine foreign policy between the US and China. According to the US Naval Institute, he has visited all South China Sea claimant countries and undertaken "field research" in Vietnam, the Philippines, Taiwan, and Brunei. He has been an associate for Booz Allen Hamilton (as once was Edward Snowden). Though he has ties with international multilateral banks, he is less of an "economic hit man" and has more interest in US security matters.

Corr led the US Army social science research already in Afghanistan and conducted analysis at US Pacific Command (USPacom) and US Special Operations Command Pacific (Socpac) for US national security in Asia, including in the Philippines, Nepal, and Bangladesh. Currently, he is researching Russia and Ukraine for the Pentagon. He has urged President Trump to use stronger military presence in the South China Sea, bullied Pakistan with sanctions, and supported independentistas in Hong Kong and Taiwan, labeled Chinese students abroad as Beijing's informants, while exploring US nuclear options against North Korea.

Such objectives are far from neutral economic observation, but they do reflect political partisanship that is typical of Washington's neoconservative and liberal imperial dreams– but not the views of most Americans, according to major polls.

In the Philippines, Duterte's supporters see Chinese debt as a business deal that will ultimately support the country's future. After Forbes, the Duterte government's critics were quick to report the story, but without appropriate examination of its economic assertions and possible strategic motives. Overall, while liberals tend to oppose the debt plans for geopolitical reasons, their economists are more sympathetic.

In any real assessment, simple realism should prevail: When the rate of economic expansion exceeds that of debt growth, low-cost financing for public projects can make a vital contribution to the Philippines' economic long-term future.

The author is the founder of Difference Group and has served as research director at the India, China and America Institute (USA) and visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Centre (Singapore).

The original story was released by The Manila Times on July 31, 2017.