Saturday morning in Davos is the time when the chief executives who attend the World Economic Forum like to head for the ski slopes. The skies are blue, the snow is pristine and the best runs are empty of holiday makers.

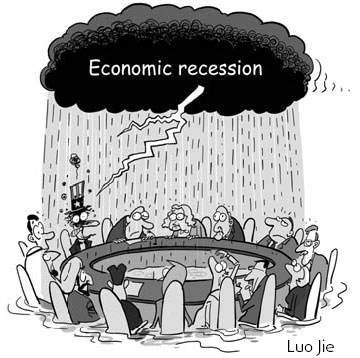

Only the hard core remains in the ugly conference centre listening to the session on the global economy chaired each year with brio by Martin Wolf of the Financial Times. This year, though, the hall was packed: what Wolf rightly called the "high tide of complacency" in 2007 has been replaced by a deep pessimism about the possibility of a United States – perhaps even a global – recession.

The gravity of the situation was best demonstrated by Dominique Strauss-Kahn, the managing director of the International Monetary Fund, who called for cuts in interest rates to be supported by a relaxation in fiscal policy by those countries with strong enough public finances to allow cuts in taxes or increases in spending.

As Larry Summers, the former US treasury secretary, noted waspishly, this was a mildly historic moment – the first time in a quarter of a century that the fund had deviated from its iron belief in balanced budgets and fiscal consolidation to call for a classic Keynesian approach to economic slowdown.

Strauss-Kahn, though, is clearly worried. He wheeled out the cliche of the moment - a perfect storm – to describe how the world had got itself into its fine old mess: a period of low interest rates leading to too much cheap money sloshing around the globe; a breakdown in credit and risk management due to the failures of self-regulation in the private sector; and short-comings in financial regulation and supervision, particularly in the US.

John Thain, the man parachuted in to sort out the problems at Merrill Lynch, said last week's emergency rate cuts by the Federal Reserve – likely to be followed by a further easing of monetary policy this week – would not be enough to spare the US from further falls in house prices, a sharp increase in personal bankruptcies and rising unemployment. Summers was equally gloomy, saying that cheaper borrowing had to be accompanied by repair of the financial system, a rescue package to prevent foreclosures in the US real estate market.

Wolf made the point that one reason for optimism was that the Davos consensus was usually wrong, and there is one school of thought that says that the doom and gloom has been overdone. The argument goes, the US has not had a single quarter of falling output, the Fed has taken decisive and timely action to get ahead of the curve, a $150 billion fiscal boost is being rushed through Congress and the US tends to display extraordinary resilience.

There is something in this. The possibility that lower interest rates and tax cuts will prove a shot in the arm for consumers in the US should not be ruled out. Gerard Lyons, the chief economist at Standard Chartered, believes that the Fed will cut its main policy rate to 1 percent by the third quarter of 2008 – a level that ought to lessen the pain for the holders of subprime mortgages who face the prospect this year of their initially cheap home loans being reset to higher rates.

Easier monetary policy from the Fed and the fund's welcome rediscovery of Keynes's General Theory are certainly appropriate. The lesson of Japan in the 1990s is that once economies get sucked into a vicious circle of collapsing asset prices, banking crises and deflation it takes a lot of time and a lot of pain to escape from them. But let us not kid ourselves. Cutting interest rates, providing the banking system with unlimited liquidity and cutting taxes are not long-term solutions to the crisis. They may not even be short-term solutions if they lead to rising US inflation, a collapsing dollar and higher long-term interest rates.

A long-term solution requires recognition that the crisis of the past six months is not the equivalent of a fit athlete suffering a muscle strain that will wear off given a bit of time and some intensive physiotherapy but rather the not quite fatal heart attack for the 60-a-day smoker. Briefly cutting down to 50-a-day is not the panacea.

In this sense, the people at Davos - despite all the somber faces this year - are still living in a dream world. There are at least five big fantasies. The first is that policymakers are in control, when all the evidence of the past decade is that they have allowed the global imbalances to develop unchecked, turned a blind eye to the excesses in asset markets and blown up a series of bubbles.

The second is that the global economy has decoupled so that problems in the US will not affect the rest of the world. This, of course, is precisely the opposite of the message of recent years, when the argument has been that globalization has increased the linkages between national economies. The idea that economies couple in good times and decouple in bad times is nonsense.

The third fantasy is to believe that the financial system is basically sound. There is still a tendency to believe that the scandal that cost Societe Generale 4.9 billion Euro was the result of the activities of a rogue trader rather than simply the most egregious example of a form of the wild gambling that has been going on unchecked. Those running the big institutions have been happy to allow derivatives traders a free hand while the profits have been rolling in.

The fourth fantasy is the assumption that the problems of the past six months are a crisis of liquidity, when they are in reality a crisis of solvency. Provision of cheap money - even in unlimited quantities – is not nearly so effective if businesses and consumers are unable to pay off their debts.

Belatedly, it has been accepted that subprime mortgages are not a little local difficulty; what has yet to be taken on board is that they have proved to be similar to an uncontrollable virus spreading through the financial system. We know about the problems of banks and we have had an inkling about the problems potentially facing monoline insurers - the companies that insure bonds - but the really big threat would be if the virus has spread to the $45 trillion market for credit default swaps, as it may well have done.

Finally, there is the fantasy that not much has to change. Today's problems are the culmination of a 20-year process that has seen curbs lifted on banks and investment houses, finance becomes a bigger and bigger part of developed economies, and a distribution of rewards in favor of those allegedly in charge of the runaway train.

It is no time for tinkering. Rather it is time to heed the warning, because it may be the last one we get.

(China Daily via The Guardian January 29, 2008)