A survey of how the business community views China's tax system has revealed overwhelming support for the government's new corporate income tax law, with 85 percent of the respondents saying it has had a positive impact on the economy.

CPA Australia, the world's sixth largest accounting body, surveyed 162 financial, accounting and business professionals across China last month, at which point the new corporate tax law had been in effect for three months.

"We are delighted with the survey findings," Henry Chan, president of CPA Australia Beijing Committee and partner with Ernst and Young China, said. "There is clear support for the corporate income tax law, and the vast majority are confident it will further strengthen China's prosperous economy."

The corporate tax rate was lowered to 25 percent from 33 percent in January. The rate for small businesses is only 20 percent, while hi-tech companies pay just 15 percent.

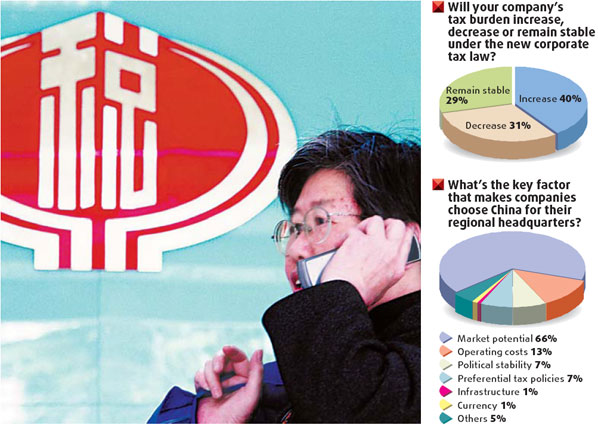

Thirty-one percent of the respondents said their organizations' tax burden would decrease, and 38 percent said their organizations would invest more in China as a result of the new law.

Forty percent said their companies would be paying more tax.

Companies operating in the country's special economic and technology development zones pay the 15 percent tax rate, but that will increase as the new law is phased in over the next five years. These companies will pay 18 percent by the end of this year, 20 percent next year, 22 percent in 2010, 24 percent in 2011 and 25 percent from 2012.

Coastal areas with a tax rate of 24 percent had to raise their rate to 25 percent this year, while the comparatively economically depressed western parts of the country will enjoy the privileged tax rate until 2010.

Noting that 43 percent of the survey's respondents said they did not know if their businesses would benefit from the transitional tax policy, Chan said certain aspects of the corporate income tax law would have to be clarified.

Environment focus

The law also reflects the government's focus on protecting the environment by offering a three-year tax exemption followed by a three-year half deduction for energy- and water-saving projects. Government bodies are expected to make the tax rate more preferential for those sectors.

Sixty-one percent of the respondents said they would like to see more tax incentives offered to businesses that embrace environmentally sound practices and technologies.

The law deducts 150 percent of enterprises' investments in environment-related research and development before collecting corporate income taxes.

However, 62 percent of the respondents said they would like to see a higher deduction rate, with 69 percent saying that a 200 percent deduction would be reasonable.

"The State Administration of Taxation and the Ministry of Finance are drawing up preferential tax policies to address these issues in a practical manner. Specific laws can be expected in the coming two months," Chan said.

As for the top concerns about taxation, respondents identified the concept of a "tax resident" system based on effective management of a firm (27 percent), compulsory transfer pricing documentation (21 percent) and controlled foreign company rules (18 percent) as the top three challenges to overcome.

When asked about the financial impact of the new law, 43 percent said they would face an increase in manpower costs to ensure compliance was met and 40 percent forecast higher expenditure in service fees paid to professionals for compliance support and advice.

"This is also encouraging news for the accounting sector. Demand for qualified accountants with international experience is at an all time high, and as China strengthens its lead role in the global economy this trend will continue," Rebecca Mak, vice-president of CPA Australia Beijing Committee and a tax partner with KPMG Huazhen in Beijing, said.

The new corporate tax law, for the first time since 1978, puts domestic and foreign firms on an equal footing in income taxation, reflecting the government's efforts to promote fair competition.

It was once assumed that inflows of foreign investment into the country would slow once the preferential tax rates for foreign firms were scrapped. But in the first two months this year, China attracted $18.1 billion in foreign direct investment (FDI), up about 75 percent year on year.

The appreciation of the renminbi against the US dollar is encouraging foreign investors to rush in. And the continuous increase in FDI reflects the country's standing as an attractive destination for foreign money.

Besides FDI, some foreign companies are also considering moving their Asian headquarters to China.

About a quarter of the respondents said that their companies would likely move their Asian headquarters to China (Beijing and Shanghai being the favored destinations), with 51 percent saying such moves could take place within the next three years.

The country's market potential was seen as the most important factor in China's attractiveness as a regional hub, with 66 percent listing it as their chief interest.

That was followed by operating costs (13 percent) and preferential tax policies (7 percent).

This suggests that the potential of the economy and a level playing field are more important to foreign investors than taxes.

Seventy-two percent of the respondents supported the idea of granting preferential tax policies to companies setting up regional headquarters in China.

"Hong Kong offers low tax rates and Singapore offers tax benefits to attract companies to establish regional headquarters in those jurisdictions. If the government wants to position the mainland as a competitive regional headquarters, a special tax regime will need to be put in place," Chan said.

(China Daily April 11, 2008)